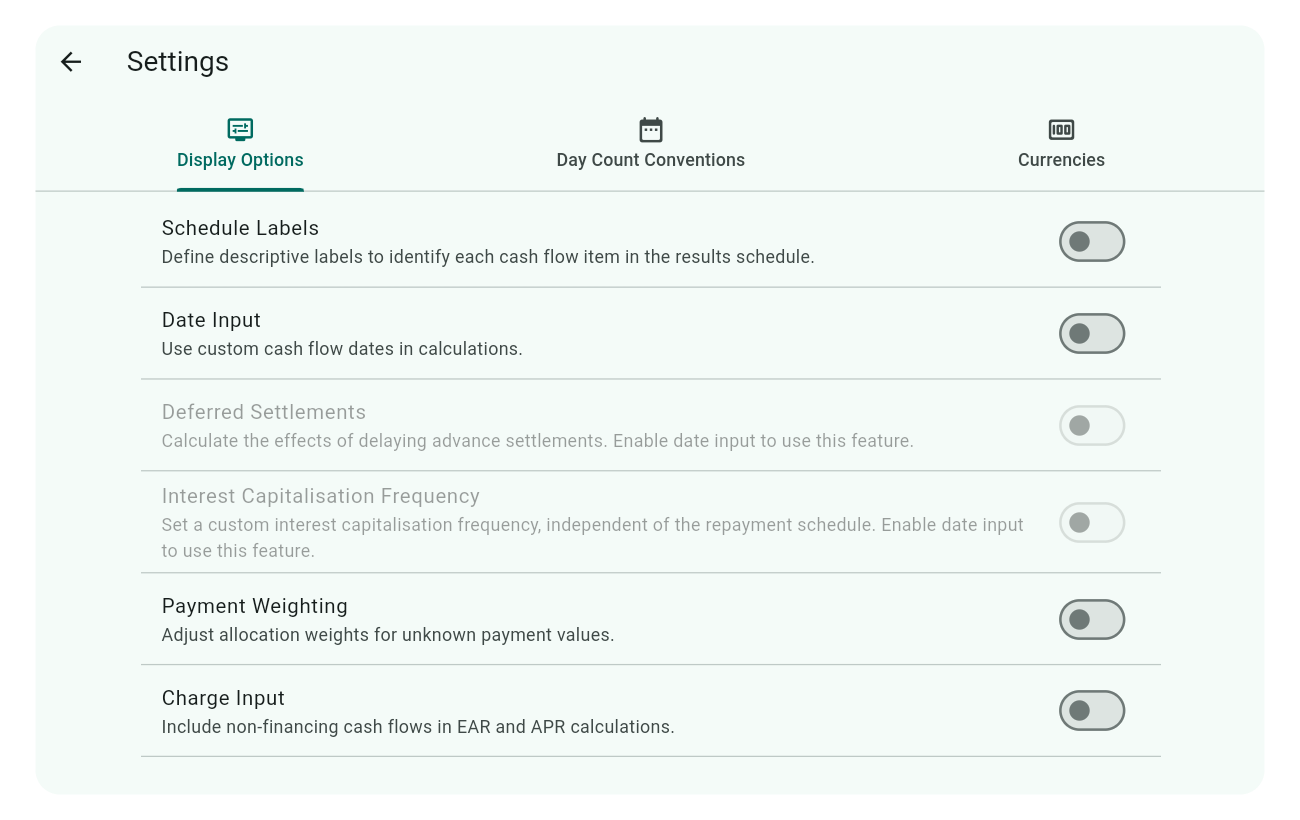

Display Options

Important

Here’s how the Display Options appear by default, with all options disabled, catering to simple financial calculations for everyday use:

For users with more complex needs, consider enabling the following features:

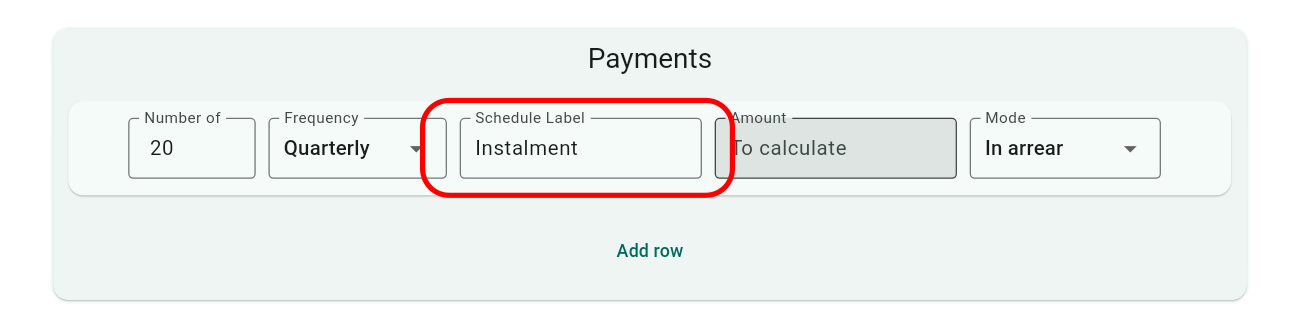

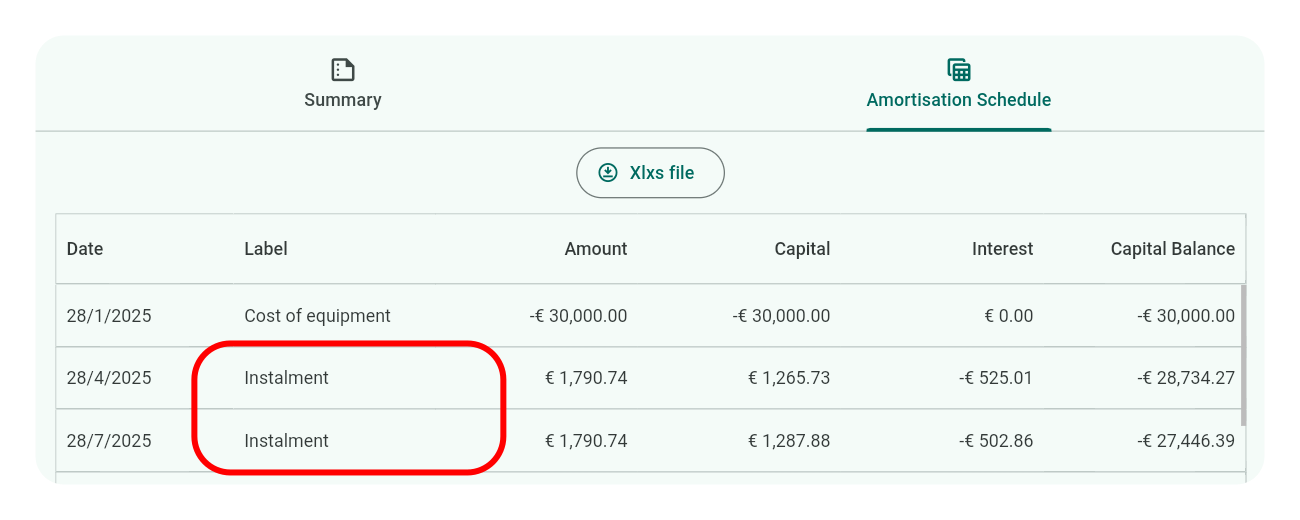

Schedule Labels

Enable this feature to add descriptive labels to each row under Advances, Payments, or Charges in the calculator input screen.

These labels appear in the results schedules, providing context for each entry.

Tip

Use singular forms for labels like “Rental” instead of “Rentals” for clarity in individual row descriptions.

Date Input

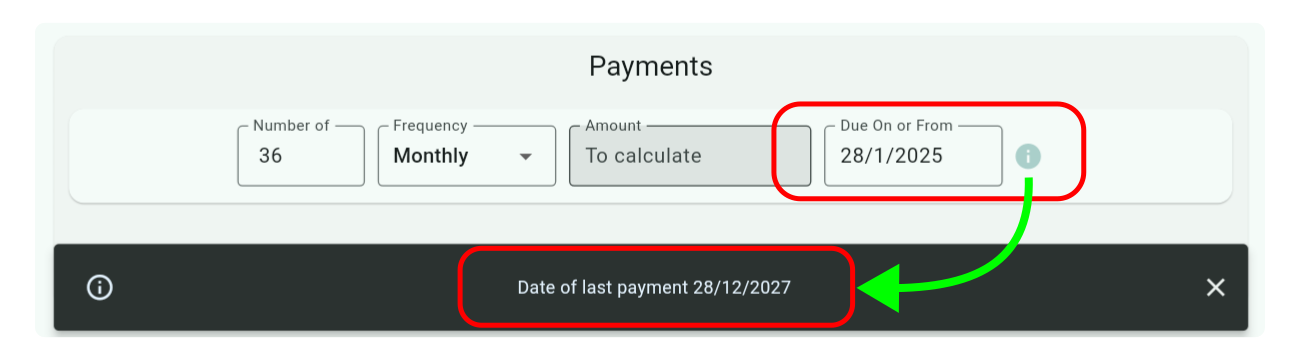

Activate this feature to manually set custom cash flow dates for your calculations. Once activated, the date input fields replace the Mode dropdowns in the calculator input, and the dates entered mark the start of each series.

Note

An information icon next to date fields in the Payments section provides additional context. Tapping this icon will display a snackbar at the bottom of the screen, revealing the date of the last payment in the series. This is crucial for constructing complex payment schedules.

For Detailed Usage: Explore examples 07, 09, 10, 12, 13, 14, and 15 for a thorough understanding of how to apply date inputs in various scenarios.

Important

Calculations always use dates, whether this feature is enabled or not. If disabled, the calculator uses dates from your device/system; when enabled, it uses the dates you specify. Thus, result schedules will always display dates, unaffected by this setting.

Deferred Settlements

Activate this feature to explore how delaying payments from a lender to an equipment supplier affects financial calculations under a finance contract. This vividly illustrates the concept of the time value of money and is particularly useful for lenders, though informative for all users.

Note: Enabling date input is required for this feature to function.

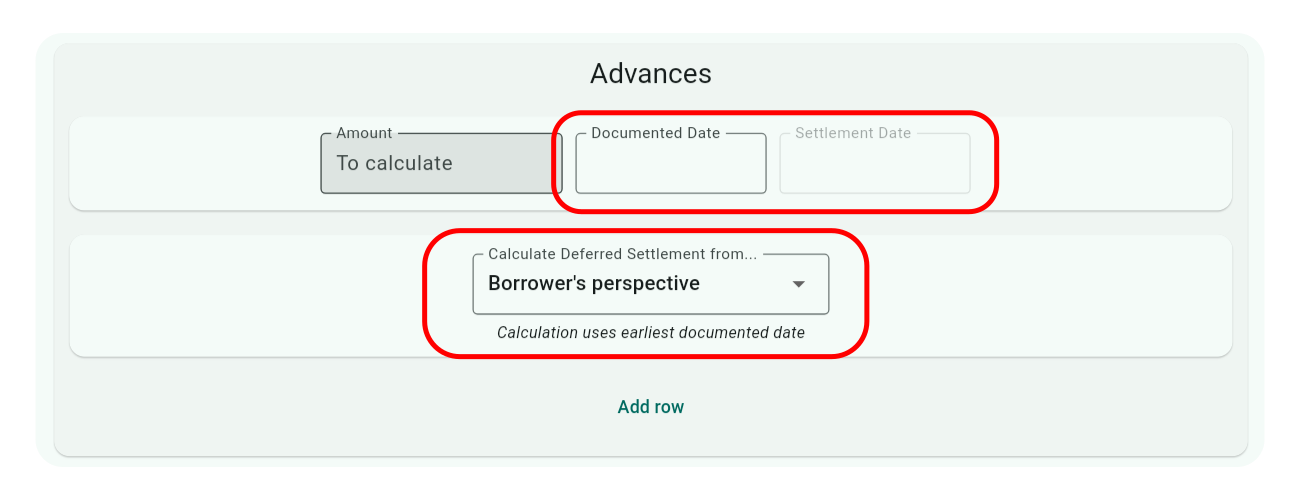

When activated, each row in the Advances section will feature two date fields:

- Documented Date: This is the start date of the finance contract from the borrower’s viewpoint or the date of subsequent drawdowns if there are multiple advances before settlement.

- Settlement Date: This date, which is on or after the Documented Date, marks when the supplier receives payment, hence the term ‘deferred settlement.’

A dropdown menu also appears, allowing you to choose the perspective for calculations:

- Borrower’s Perspective - Using the earliest Documented Date.

- Lender’s Perspective - Using the earliest Settlement Date.

For In-Depth Exploration: Check out examples 13, 14, and 15 to gain a comprehensive understanding of this feature’s application and benefits.

Interest Capitalisation Frequency

Activate this setting to customise how often interest is capitalised, independently from the repayment schedule. You must enable date input to use this feature.

Input Configuration:

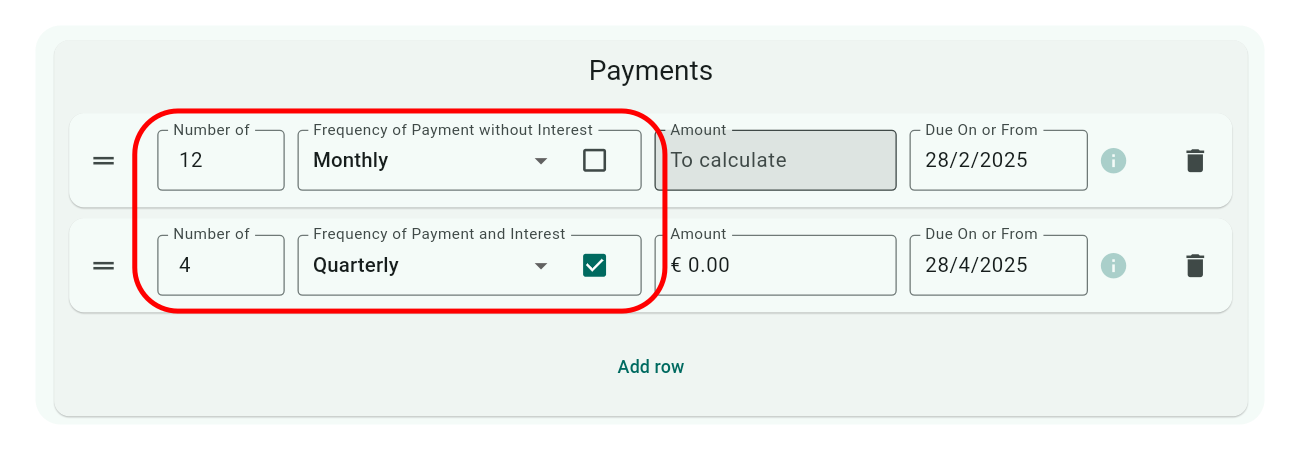

- Create at least two rows in the Payments section:

- For regular payments, uncheck the interest checkbox next to the frequency dropdown.

- For interest capitalisation, check the interest checkbox and set the amount to zero to avoid unexpected results.

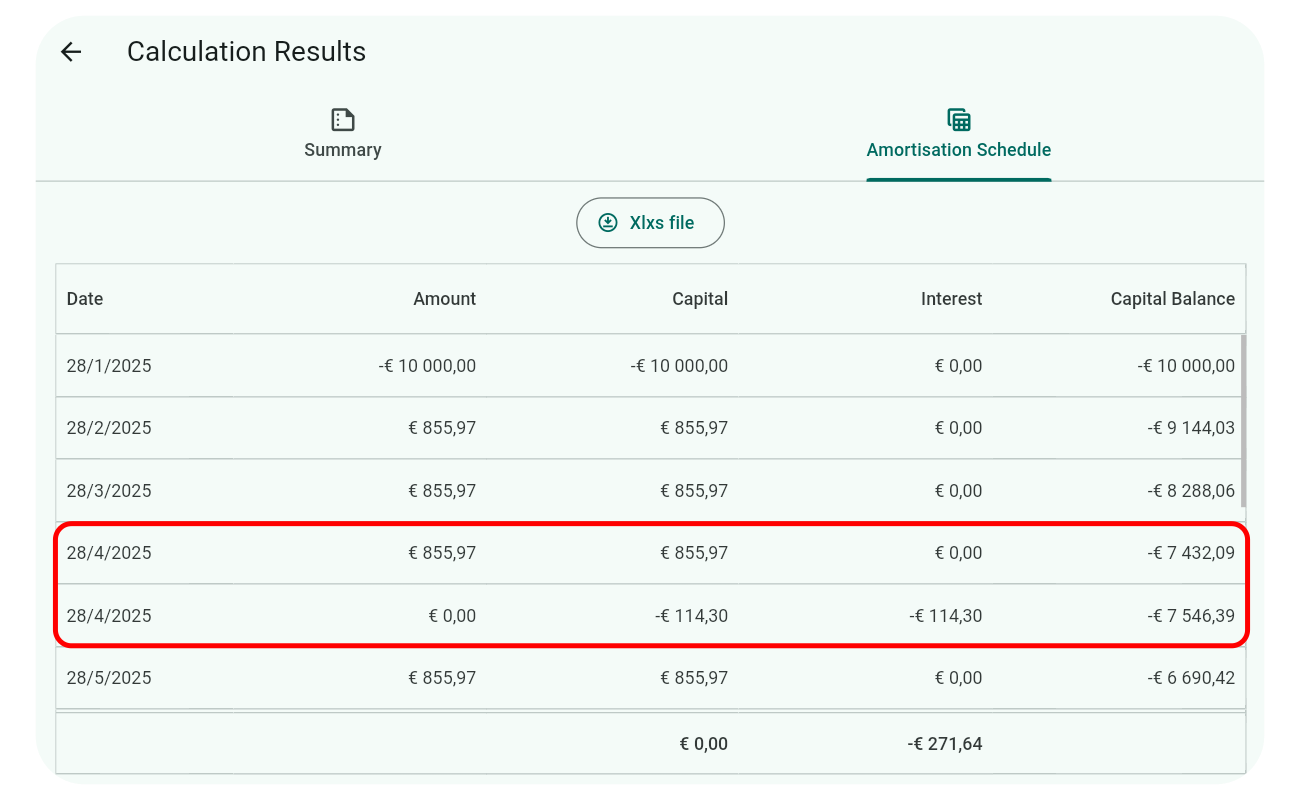

Example: The screenshots above and below show a scenario with monthly repayments and quarterly interest capitalisation. Note how every three months, the interest and repayment schedules align.

Detailed Example: For a deeper dive, see example 07.

Important

Ensure both the payment and interest schedules conclude on the same date for accurate calculations. Use the information icon next to date fields to confirm the longest dated end points of both schedules match.

Payment Weighting

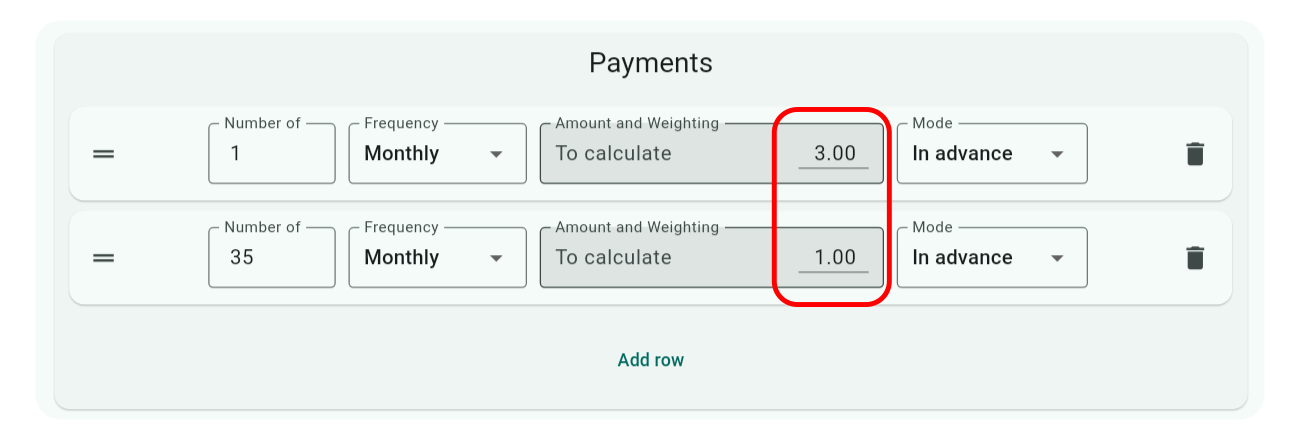

Activate this setting to allocate weights to unknown payment values when dealing with calculations involving two or more payment series rows. An additional input field appears next to the amount field for setting the weighting of the unknown value.

This feature allows for proportional distribution of an unknown payment across multiple series, rather than solving for a single value.

For In-Depth Exploration: Check out examples 05 and 08 to explore this feature’s potential.

Notes:

- Single Series Effect: Applying a weight to a single payment series does not alter the result; the entire unknown value is assigned to that series.

- Known Payments: If a payment value is known, a weighting of 1 is automatically applied and cannot be changed.

Charge Input

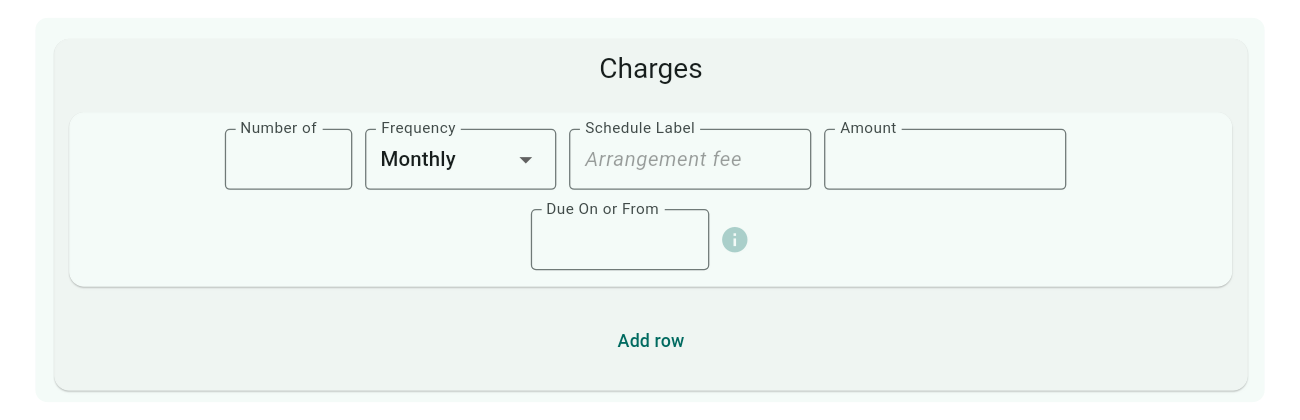

Enable this setting to include non-financing cash flows in calculations. A Charges section appears on the input screen when activated.

Curo Calculator can solve for unknown interest rates or cash flow values, taking these defined charges into account. This is particularly useful for calculating legally mandated APR interest rates, which must include all mandatory charges associated with consumer credit agreements.

Each charge series row includes a Payment Method drop-down menu, allowing you to specify whether the charge is Cash-paid (paid directly by the borrower) or Financed (financed and added to the loan principal). This selection determines whether the charge is included in calculations, depending on the chosen Day Count Convention:

- Standard Conventions (e.g., 30/360, Actual/Actual): Cash-paid charges are excluded as they do not affect the financed amount, while Financed charges are included as they increase the principal.

- APR/EAR Conventions (e.g., US Appendix J APR, EU 2023/2225 APR): Cash-paid charges are included as they impact the total borrowing cost, while financed charges are excluded as they are assumed to be part of the provided rate or cash flows.

The table below summarizes how charges are handled based on the day count convention:

| Day Count Convention Type | Cash-paid Charge Included? | Financed Charge Included? |

|---|---|---|

| Standard Conventions | No | Yes |

| APR/EAR Conventions | Yes | No |

In the screenshot, both Label and Date inputs have been activated in Settings. For calculations involving charges, enabling Date Input is advisable to account for one-off charges at the end of the finance term.

For Detailed Usage: Explore example 18 to see how charges are applied in APR calculations.

Tip

Use the Payment Method drop-down to accurately model charges for regulatory compliance, such as including Cash-paid charges in US Appendix J APR, EU 2023/2225 APR, or other APR calculations.