Example 18

Determine the APR implicit in a repayment schedule, including charges

This example demonstrates how to calculate the Annual Percentage Rate (APR) for a consumer loan, in accordance with the European Union directive 2023/2225.

This example is invaluable for anyone dealing with consumer finance within the European Union, as it illustrates how to calculate the Annual Percentage Rate (APR) implicit in repayment profiles, including any charges. Understanding the APR is essential as it encapsulates the total cost of borrowing, providing a standardised metric for comparing different loans.

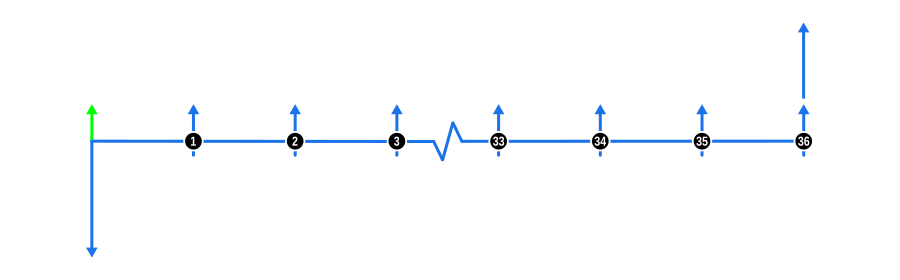

The diagram below visualises the cash flow dynamics of a standard repayment profile in Arrears, including a single charge:

Example Calculation Inputs

- Advance: Depicted by a blue downward arrow at the start of the timeline, this represents the full cash price or loan value, known from the outset.

- Payments: The blue upward arrows signify regular payments made in arrears, meaning at the end of each payment period. The large blue upward arrow coinciding with the final payment represents a balloon payment, often used to align with the residual value of an asset or to defer a significant portion of the repayment.

- Charges: There is one charge due at the outset of the contract, represented by a green up arrow, which could include fees like an origination fee or setup costs.

- Interest Rate: Since we’re solving for this, ensure the calculator’s interest rate field is empty.

TIP

When you’re comfortable determining the APR implicit in a repayment profile, why not get a little more creative? Did you know Curo Calculator can be used to determine an unknown value in a repayment profile that includes charges, ensuring an exact APR yield is obtained? It can, so try it out!

Benefits and Implications

- Consumer Protection: By calculating the APR, consumers can make informed decisions, ensuring they understand the full cost of loans, including all associated charges.

- Regulatory Compliance: This example adheres to EU standards, helping financial institutions comply with consumer credit directives, ensuring transparency in lending practices.

- Loan Comparison: APR is a universal measure for comparing different loan offers, especially when they include various fees or charges, making it easier to choose the most cost-effective option.

- Financial Literacy: Educates users on how charges affect the overall cost of borrowing, promoting better financial decision-making.

- Negotiation: Knowing how to calculate APR gives borrowers leverage in negotiations, particularly when discussing how fees and charges should be structured or reduced.

- Business Decisions: For businesses offering credit, understanding how to calculate APR ensures they can price their loan products competitively while still covering costs and maintaining profitability.

This example not only teaches you to compute APR but also highlights its importance in the broader context of consumer finance within the EU, empowering both lenders and borrowers to navigate the financial landscape more effectively.