Example 17

Determine the EAR implicit in a repayment schedule

This example demonstrates how to calculate the Equivalent Annual Rate (EAR) of interest inherent in a standard repayment schedule.

Note that all EAR day count conventions available in this calculator yield results comparable to legally defined Annual Percentage Rate (APR) conventions, making them excellent substitutes for APR calculations in jurisdictions without a defined APR standard.

This example illustrates the use of Effective Annual Rate (EAR) day count conventions and is included for the benefit of users outside the European Union who need a substitute method for calculating an Annual Percentage Rate (APR). The EAR conventions often mirror legally defined APR methods, providing a good proxy. Understanding the Effective Annual Rate (EAR) is crucial for anyone dealing with finance, as it reveals the true annualised cost of borrowing.

This example serves as a foundational guide for calculating EAR in a repayment profile, equipping users with the knowledge to assess the economics of any loan or investment, from the simplest to the most complex structures.

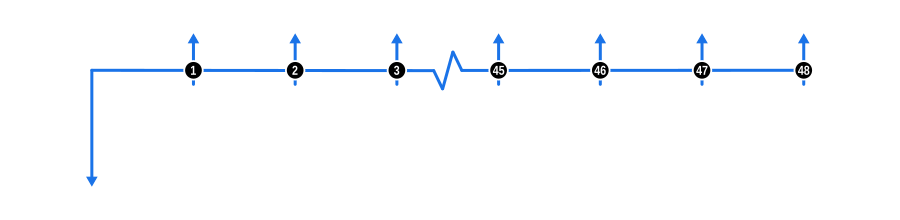

The diagram below visualises the cash flow dynamics of a standard repayment profile in Arrears:

Example Calculation Inputs

- Advance: Depicted by a blue downward arrow at the start of the timeline, this represents the full cash price or loan value, known from the outset.

- Payments: The blue upward arrows signify regular payments made in arrears, meaning at the end of each payment period.

- Interest Rate: Since we’re solving for this, ensure the calculator’s interest rate field is empty.

TIP

This example does not incorporate Charge cash flows, which is something you may wish to do when determining the EAR implicit in a repayment profile. So, once you’ve mastered these calculations, why not add one or two charges and evaluate firsthand the impact a seemingly small charge has on the annual rate?

Benefits and Implications

- Global Financial Literacy: Understanding EAR provides a universal language for discussing the cost of borrowing, especially useful in regions where APR isn’t standardised.

- Accurate Comparison: Use EAR to accurately compare financial products from different countries or financial systems, ensuring you’re comparing apples to apples.

- Consumer Advocacy: By calculating EAR, consumers can advocate for themselves, ensuring they’re not misled by nominal rates that don’t reflect the true cost of borrowing.

- Financial Planning: Knowing the EAR helps in long-term financial planning, giving a clearer picture of how much borrowing will cost over a year, influencing decisions on loan terms or investment strategies.

- Educational Tool: This example serves as an educational tool to understand how compounding affects the effective cost of loans, particularly when dealing with different compounding frequencies or additional fees.

This exercise not only enhances your ability to work with financial calculations but also deepens your understanding of how various elements of a loan or investment can impact your financial decisions.