Example 15

Determine a lender’s NAR in a deferred settlement scheme

Building on Example 13 and linking to Example 14, this example shows how to compute the lender’s Nominal Annual Rate (NAR) of interest, similar to the IRR, in a deferred settlement scenario. The NAR calculation uses the settlement date, not the documented date, confirming that the lender’s rate or yield from Example 13 remains unaffected by the deferral.

This example illustrates the use of the Deferred Settlements calculator feature to verify that the Nominal Annual Rate (NAR) of interest implicit in a repayment profile, which accounts for the deferral of a supplier’s settlement, aligns with the original yield used to calculate the unknown payment value in Example 13. While Example 14 calculated the NAR from the borrower’s perspective, here we focus on the lender’s view to ensure financial consistency.

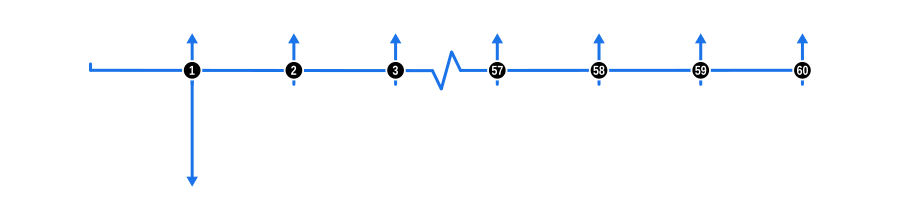

The Deferred Settlement feature is designed specifically for use by Finance Professionals, though the example should be informative for all users. The diagram below visualises the cash flow dynamics:

Example Calculation Inputs

- Advance: The cost of the goods (advance) is shown as a blue downward arrow, located on the timeline when the supplier settlement occurs.

- Payments: The known payments are represented by blue upward arrows. In the calculator, enter the result obtained in Example 13 into the payment fields.

- Interest Rate: As this is what we are solving, clear the calculator input field.

In the calculator input screen, at the foot of the Advances section, is a dropdown to select the perspective to use in solving the unknown interest rate. As we are determining the NAR from the Lender’s Perspective, ensure that option is selected so the calculation is performed with reference to the Settlement Date.

Benefits and Implications

- Verification of Yield: Ensures the lender’s expected return or yield is accurately reflected in the payment schedule, even after accounting for deferred settlements.

- Financial Oversight: Provides a mechanism for lenders to double-check their financial models, ensuring all calculations align with their financial strategy.