Example 13

Determine a payment in a deferred settlement scheme

This example shows how to calculate a payment considering a short deferral of the amount due to an equipment supplier under a finance contract. This calculation is relevant for lenders with close ties to suppliers, allowing them to defer payments and pass on benefits like reduced payments or interest to borrowers. This technique is often used in competitive bidding where even slight interest rate reductions can be decisive. Note that borrowers and others using this calculator won’t know about this commercial relationship, so this example serves mainly for informational purposes.

This example illustrates how a lender can leverage a strong supplier relationship and make arrangements to defer settlement on equipment supplied to the borrower at the conclusion of a financing arrangement. In very many cases, the borrower is unaware of this arrangement, yet still enjoys the benefits of deferral in the form of a lower interest rate and reduced repayments.

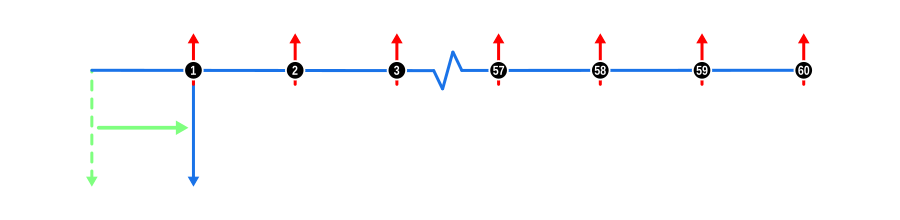

Furthermore, this example demonstrates usage of the Deferred Settlements calculator feature to determine borrower repayments, using a lender’s desired return and taking into account the deferred settlement. In Examples 14 and 15, we show you how to calculate the Nominal Annual Rate (NAR) of interest implicit within the repayment profile from the Borrower and Lender perspective respectively. This feature is designed specifically for use by Finance Professionals, though the example should be informative for all users. The diagram below visualises the cash flow dynamics:

Example Calculation Inputs

- Advance: The cost of the goods (advance) is shown as a blue downward arrow. In this example, the Advance arrow has been shifted from the start of the timeline, which is the Borrower’s perspective of the repayment profile, to the point in time the amount becomes due. This shift is illustrated by the light green arrow and reflects the financing arrangement from the Lender’s Perspective.

- Payments: The unknown payments are represented by red upward arrows.

In the calculator input screen, at the foot of the Advances section, is a dropdown to select the perspective to use in solving the unknown payment value. As the lender is passing on the benefits of the deferral to the borrower, ensure the Lender’s Perspective option is selected so the calculation is performed with reference to the Settlement Date.

Benefits and Implications

For the Borrower:

- Reduced Rates/Repayments: The deferral can result in lower interest rates or smaller payment amounts, making the financing more affordable or attractive.

- Enhanced Affordability: Lower payments can make high-cost items more accessible or allow for better cash flow management.

- Unaware Advantage: Borrowers benefit from the arrangement without needing to understand the underlying commercial relationships, potentially increasing their satisfaction with the financing terms.

For the Lender:

- Maintains Yield: By deferring the settlement, the lender can maintain or even increase their yield without altering the interest rate visible to the borrower, as the cost savings from deferral are passed on.

- Competitive Edge: This can be a strategic tool in competitive markets, allowing lenders to offer better terms without compromising their profitability.

- Relationship Building: Strengthens ties with suppliers, which can lead to exclusive deals or better terms in future transactions.

For the Supplier:

- Improved Stock Turnover: Deferring payment terms can help move inventory more quickly, especially for high-value or slow-moving items, reducing holding costs.

- Sales Security: Securing sales under deferred terms is often preferable to keeping items in stock, potentially avoiding depreciation or obsolescence.

- Market Positioning: Can position suppliers as flexible partners willing to negotiate terms to close deals, appealing to lenders and borrowers alike.

- Cash Flow Management: While the payment is deferred, the sale is secured, allowing for better cash flow forecasting and management.

This deferred settlement scheme exemplifies how strategic partnerships can lead to mutual benefits, allowing for more cost-effective financing solutions while maintaining profitability and liquidity across the chain from supplier to lender to borrower.