Example 12

Determine the supplier discount required - own lender versus 0% finance scheme

Expanding on Example 10, this example shows how to calculate the minimum supplier discount necessary to equal the benefits of a 0% finance scheme if you opt for your own lender. Here, you can use your lender’s interest rate to ensure the discount leaves you financially neutral.

This example covers the topic of 0% and low-interest finance schemes from the perspective of a borrower wishing to secure the financial benefits associated with 0% finance when using own lender finance. Examples 10 and 11 cover the same topic with slight variations from the perspective of a 0% finance lender, and a cash buyer.

This example, like the previous two, should be informative for all users.

As with cash buyers, it is important for a borrower wanting to use their own lender facilities to understand how 0% finance works as it is from the analysis of the financial cash flows that the value of a potential cash discount can be derived and used as a starting point in supplier negotiations. Similarly, the results and schedules produced by the calculator beyond that single discount figure are of little relevance, so can be safely ignored. With that covered, let’s move on!

0% finance profiles can be characterised as containing disclosed and non-disclosed cash flows.

- The disclosed cash flows, which a borrower is aware of, are the full retail cost (advance) of the financed item and the payment cash flows which contain principal only; the sum of payment cash flows equals the item cost (advance), hence 0% interest.

- The non-disclosed cash flows are the direct transactions between supplier and lender, usually a cash discount to offset the financing costs of the lender.

There is no need to be concerned about the non-disclosed cash flows; the calculation will use your own lender interest rate as a proxy to calculate this. In this way, you can be assured the discount will leave you financially neutral. What this means is the total cost of finance using your own lender will be equal to or better than the total repayable under a 0% finance arrangement, provided the repayment profile remains unchanged. How you obtain the disclosed cash flow information is simple. It is usually advertised by a supplier, and if it is not, request a finance quote… before you start talking discounts!

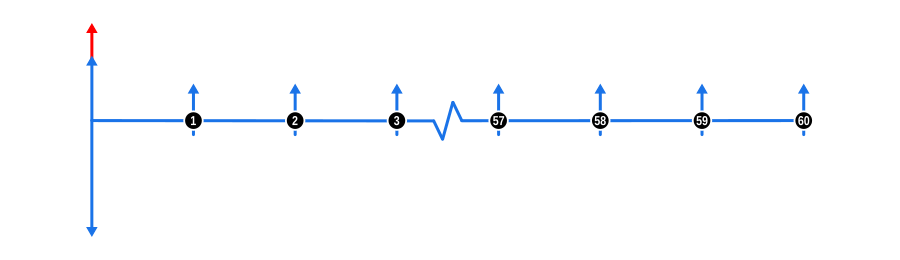

The diagram below visualises the cash flow dynamics for a hypothetical finance quote:

Example Calculation Inputs

- Advance: The full retail cost of the goods (before discount) is shown as a blue downward arrow at the start of the timeline.

- Payments: The quoted payments are represented by blue upward arrows. The supplier discount, derived by discounting these future payments, is shown by a red upward arrow above the quoted upfront deposit at the start of the timeline.

- Interest Rate: Although not shown in the diagram, the rate should reflect what your own lender has quoted.

Benefits and Implications

For the Own Lender Borrower:

- Flexibility in Repayment Terms: Ability to negotiate different repayment terms with your own lender, which might offer better personal or business alignment than standard 0% finance terms (though this might alter the financial comparison).

- Utilisation of Existing Credit: Make use of already approved credit lines, potentially avoiding additional credit checks or delays in securing finance.

- Relationship Maintenance: Strengthen or maintain a good relationship with your existing lender, which can be beneficial for future financing needs.

- Control Over Financing: Greater control over the financing process, including potentially lower interest rates or more favourable conditions than those offered in 0% schemes.

- Customisation: Tailor the financing to match specific cash flow needs, potentially reducing overall interest costs if the loan term is adjusted accordingly.

For the Supplier:

- Cash Flow Improvement: Receiving a cash discount from the supplier to the borrower’s lender can still improve the supplier’s cash flow similar to a cash deal.

- Maintaining Profit Margins: The discount effectively goes to the borrower’s lender instead of a third-party finance provider, maintaining the supplier’s profit margin.

- Increased Sales Volume: Offering competitive discounts can still lead to higher sales as it matches or beats the appeal of 0% financing, even if the buyer uses their own financing.

- Customer Loyalty: Providing flexibility in finance options can foster customer loyalty, encouraging repeat business, even if the immediate transaction doesn’t directly benefit from the 0% finance deal.

- Market Positioning: Can position the supplier as adaptable and customer-centric, appealing to buyers who value flexibility in their financing options.

- Simplified Sales Process: Potentially fewer complications in sales agreements since the financing terms are handled externally by the buyer’s lender, reducing administrative overhead.

This setup allows borrowers to leverage their existing financial relationships while still securing discounts comparable to 0% finance schemes, providing a strategic advantage in purchasing decisions.