Example 11

Determine the supplier discount required - cash versus 0% finance scheme

Building on Example 10, this example demonstrates how to calculate the minimum supplier discount needed to match the financial perks of a 0% finance scheme when paying with cash. Like before, you’ll have to estimate the lender’s interest rate for this calculation.

This example covers the topic of 0% and low-interest finance schemes from the perspective of a buyer wishing to secure the financial benefits associated with 0% finance when paying cash. Examples 10 and 12 cover the same topic with slight variations from the perspective of a 0% finance lender, and a borrower wanting to use a 3rd party lender.

This example, like the previous and the next, should be informative for all users.

As a cash buyer, it is important to understand how 0% finance works as it is from the analysis of the financial cash flows that the value of a potential cash discount can be derived and used as a starting point in supplier negotiations. The results and schedules produced by the calculator beyond that single discount figure are of little relevance, so can be safely ignored. With that covered, let’s move on!

0% finance profiles can be characterised as containing disclosed and non-disclosed cash flows.

- The disclosed cash flows, which a borrower is aware of, are the full retail cost (advance) of the financed item and the payment cash flows which contain principal only; the sum of payment cash flows equals the item cost (advance), hence 0% interest.

- The non-disclosed cash flows are the direct transactions between supplier and lender, usually a cash discount to offset the financing costs of the lender.

There is no need to be concerned about the non-disclosed cash flows; the calculation will use your best guess interest rate as a proxy to calculate this. How you obtain the disclosed cash flow information is simple. It is usually advertised by a supplier, and if it is not, request a finance quote… before you start talking discounts!

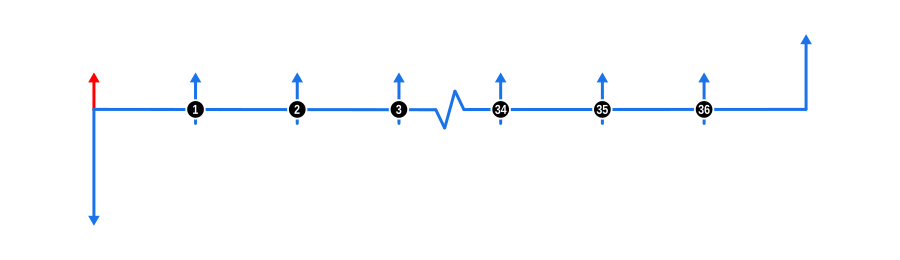

The diagram below visualises the cash flow dynamics for a hypothetical finance quote:

Example Calculation Inputs

- Advance: The full retail cost of the goods (before discount) is shown as a blue downward arrow at the start of the timeline.

- Payments: The quoted payments are represented by blue upward arrows. The supplier discount, derived by discounting these future payments, is shown by a red upward arrow at the start of the timeline.

- Interest Rate: Although not shown in the diagram, the rate should reflect the market rate for a similar transaction. Sometimes this can only be based on guesswork, so perform a range of calculations to obtain a sense of what may be a good figure to aim for.

Benefits and Implications

For the Cash Buyer:

- Negotiation Power: Understanding this calculation empowers cash buyers to negotiate discounts that effectively replicate the benefits of 0% financing.

- Immediate Savings: The buyer gets the financial benefit upfront rather than over time, potentially improving cash flow management.

- Avoidance of Financing Risks: By paying cash, buyers avoid any potential risks associated with financing, like changes in credit status or interest rates.

- Simplified Purchase: No need to deal with loan documents, credit checks, or repayment schedules, simplifying the buying process.

For the Supplier:

- Cash Flow Improvement: Immediate cash payment can improve the supplier’s cash flow, allowing for better inventory management or investment opportunities.

- Supplier Not Losing Out: The discount given to the cash buyer is equivalent to what would have been given to the lender, maintaining the same profit margin.

- Increased Sales Volume: Offering cash discounts can lead to more sales, especially if it matches or beats the appeal of 0% financing deals.

- Customer Loyalty: Providing competitive discounts can foster customer loyalty, encouraging repeat business.

- Reduced Administrative Costs: Less paperwork and administration associated with financing arrangements, potentially reducing operational costs.

- Follow-on Opportunities: With the sale secured, suppliers can look forward to subsequent sales from maintenance, servicing, or related products, which are often more lucrative.

- Market Positioning: Can position the supplier as flexible and customer-focused, appealing to buyers who prefer cash transactions or are wary of financing.

This approach demonstrates how understanding finance structures can lead to mutual benefits, where the cash buyer secures immediate financial benefits, and the supplier maintains profitability while potentially increasing customer satisfaction and future business opportunities.