Example 10

Determine the supplier discount - 0% finance scheme

This example demonstrates how to calculate the supplier discount that offsets financing costs in 0% finance deals, often seen in vehicle purchases. If the terms between the supplier and lender are undisclosed, you’ll need to estimate the lender’s interest rate using current market rates to accurately determine this discount.

This example covers the topic of 0% and low-interest finance schemes from the perspective of a 0% finance lender. Examples 11 and 12 cover the same topic with slight variations from the perspective of a cash buyer seeking a discount, and a borrower wanting to use a 3rd party lender.

0% finance profiles can be characterised as containing disclosed and non-disclosed cash flows.

- The disclosed cash flows, which a borrower is aware of, are the full retail cost (advance) of the financed item and the payment cash flows which contain principal only; the sum of payment cash flows equals the item cost (advance), hence 0% interest.

- The non-disclosed cash flows are the direct transactions between supplier and lender, usually a cash discount to offset the financing costs of the lender.

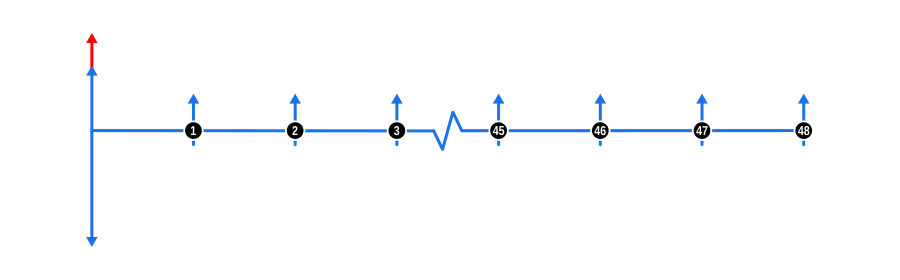

This example, and the next two, should be informative for all users. The diagram below visualises the cash flow dynamics:

Example Calculation Inputs

- Advance: The full retail cost of the financed goods is shown as a blue downward arrow at the start of the timeline.

- Payments: The known borrower payments are represented by blue upward arrows. The supplier discount required to offset the financing costs is shown by a red upward arrow above the borrower’s upfront deposit at the start of the timeline.

- Interest Rate: Although not shown in the diagram, the rate should reflect the return required by the lender.

Benefits and Implications

Mutual Benefits for Lender and Supplier:

- New Lending Opportunities: For lenders, 0% finance deals are a way to expand their loan portfolio without directly charging interest to the borrower, instead getting compensated by the supplier.

- Improved Stock Turnover: Suppliers benefit from quicker sales cycles as financing makes their products more attractive, reducing inventory holding costs.

Marketing Strategy:

- Competitive Edge: Offering 0% finance can be a significant marketing tool for both parties, attracting customers who might not purchase otherwise due to cost concerns.

Cost Management:

- Discount as Compensation: The supplier discount is essentially the cost of capital for the lender, which must be calculated to ensure the deal remains profitable for both parties.

Customer Acquisition:

- Lower Barrier to Purchase: By removing interest costs, these deals lower the entry barrier for customers, potentially increasing sales volume.

Risk Management:

- Credit Risk: Lenders might take on more risk since they’re not charging interest directly to the consumer, but they mitigate this through the discount from the supplier.

- Supplier Risk: The supplier must ensure the discount doesn’t erode too much profit, balancing between sales volume and profit margin.

Market Dynamics:

- Pricing Strategy: This model can influence market pricing, where suppliers might adjust their list prices knowing discounts will be given to offset financing.

Regulatory Considerations:

- Disclosure: Both lenders and suppliers must navigate regulations regarding how such deals are advertised and disclosed to consumers to avoid misleading marketing.

Financial Planning:

- Cash Flow: Suppliers need to plan for the immediate cash outflow due to discounts, while lenders must manage the timing of their cash inflows from repayments.

Consumer Perception:

- Value Perception: The perception of getting “free” financing can lead to increased customer satisfaction and loyalty, even if the product’s list price might be adjusted to account for this.

This arrangement highlights a strategic partnership between suppliers and lenders, where careful calculation and transparency in undisclosed cash flows are crucial for maintaining a beneficial relationship while providing value to the end consumer.