Example 9

Determine a payment with periodic token payments

This example shows how to calculate a payment schedule with small, regular ’token’ payments and larger, less frequent payments, usually half-yearly or yearly. This structure is common in agricultural lending, where payments match seasonal income, and the token payments help prevent interest from compounding.

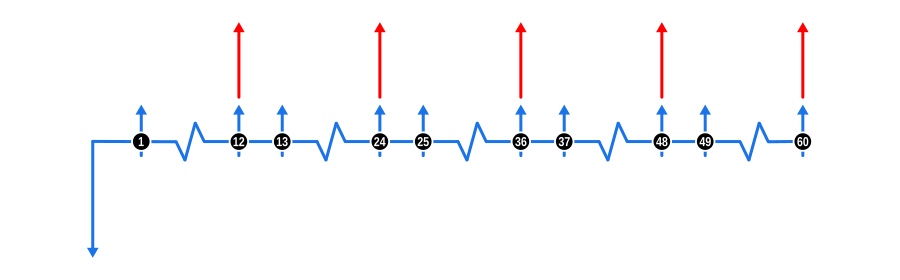

This example illustrates how to incorporate frequent token or contact payments into a repayment structure that has larger, less frequent repayments. It is designed specifically for Finance Professionals, though it should be informative for all users. The diagram below visualises the cash flow dynamics:

Example Calculation Inputs

- Advance: This is shown by a blue downward arrow at the start of the timeline, indicating the value is known.

- Payments: The frequent monthly contact payments are represented by blue upward arrows, and the larger, less frequent annual payments are represented by red upward arrows. Note that each annual payment coincides with the 12th consecutive contact payment, so in practice, these are lumped together as a single payment.

Benefits and Implications

This payment structure is particularly beneficial in scenarios where cash flows are seasonal or irregular:

Seasonal Income Alignment:

- Agricultural and Seasonal Businesses: Matches repayment with harvest or sales seasons, ensuring payments are made when income is highest.

- Cash Flow Management: Small token payments keep the loan from defaulting or accruing excessive interest during low-income periods, while larger payments clear substantial portions of the principal when funds are available.

Interest Management:

- Reducing Compounding Interest: Token payments serve to partially pay down interest, reducing the amount of interest that compounds over time, thus saving on total interest costs.

Risk Mitigation for Lenders:

- Consistency: Regular small payments provide a steady, albeit minor, cash flow, reducing some risk of default by keeping the loan active.

- Security: Larger periodic payments act as checkpoints to ensure the loan remains on track, providing security against the risk of non-payment over longer intervals.

Borrower Flexibility:

- Budgeting: Helps in budgeting for both borrowers and lenders, as small payments are predictable and manageable, with the larger payments planned around anticipated income spikes.

Encouraging Loan Commitment:

- Engagement: Frequent small payments can psychologically commit the borrower more to the loan, reducing the likelihood of default.

Tax and Financial Planning:

- Deductions: For borrowers, regular payments might offer more consistent tax deductions, while the larger payments can be planned around fiscal year ends for tax advantages.

Customisation for Borrower Needs:

- Tailored Solutions: Lenders can offer this structure to cater specifically to industries or clients with known seasonal cash flow patterns, enhancing customer satisfaction and loyalty.

Market Expansion:

- Market Fit: This structure can open up lending to sectors traditionally seen as high risk due to their income cycles, by adapting the repayment schedule to their financial rhythm.

Regulatory and Compliance:

- Transparency: Ensures clarity in loan agreements, detailing when and how much will be paid, aiding in compliance with consumer protection laws.

Implementing such a repayment structure requires careful planning but can lead to a win-win situation where both lenders manage risk effectively, and borrowers manage their cash flows in alignment with their business cycles.