Example 8

Determine a payment using a weighted profile

This example demonstrates how to calculate a payment schedule where early and mid-term payments focus on reducing the principal faster. This method is often adopted in small business loans to align with asset depreciation rates.

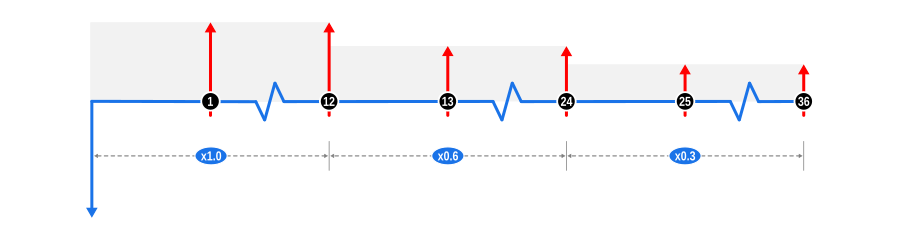

This example illustrates solving unknown payments on a proportional basis to accelerate capital repayment using a stepped profile. It makes use of the Payment Weighting calculator feature and is designed specifically for Finance Professionals, though it should be informative for all users. The diagram below visualises the cash flow dynamics:

Example Calculation Inputs

- Advance: This is shown by a blue downward arrow at the start of the timeline, indicating the value is known.

- Payments: The regular unknown payments are represented by red upward arrows. As the example uses three 12 monthly payment series with assigned weightings of 1.00, 0.60, and 0.30 respectively, we’ve adjusted the height of the upward arrows to reflect the reduction in payment values over time, and have also used a light grey background to emphasise the stepped profile.

Benefits and Implications

These types of repayment schedules are often found in business lending, with the following benefits and considerations:

Accelerated Principal Reduction:

- Risk Mitigation for Lenders: By front-loading payments, the principal is reduced more quickly, thereby lowering the lender’s exposure to credit risk over time.

- Interest Savings for Borrowers: Paying down the principal faster reduces the total interest paid over the life of the loan, benefiting the borrower financially.

Alignment with Business Cycles:

- Cash Flow Management: This structure can be tailored to match expected business income, where higher payments are feasible during peak revenue periods, and lower payments during slower times.

- Depreciation Matching: For assets that depreciate more rapidly in the early years, this payment structure can align repayments with the asset’s useful life, improving financial reporting and tax planning.

Incentivising Borrower Performance:

- Performance-Based Repayments: Can be structured to reward early success or growth in business by allowing for lower payments if certain performance metrics are met.

Flexibility in Loan Structuring:

- Customisation: Lenders can customise loan terms to better fit the financial trajectory of the borrowing business, potentially attracting clients with bespoke financial solutions.

- Negotiation Leverage: Offers a negotiation point where both parties can discuss how the payment schedule reflects actual or projected cash flows.

Regulatory and Compliance:

- Transparency: Must be clearly communicated to avoid misunderstandings about payment obligations, which is crucial for maintaining trust and compliance with lending regulations.

Market Differentiation:

- Competitive Edge: Lenders offering stepped payment profiles can differentiate themselves in the market, appealing to businesses looking for repayment plans that adapt to their growth patterns.

Loan Portfolio Management:

- Diversification: Allows lenders to diversify their loan portfolio with varied repayment structures, potentially spreading risk across different types of loan products.

Encouraging Financial Discipline:

- Discipline in Borrowing: Encourages businesses to manage their finances more stringently in the early stages of the loan, fostering a culture of financial discipline.

This stepped payment approach provides a strategic tool for both lenders and borrowers to manage financial obligations in a manner that supports business growth while minimising risk exposure for the lender. It’s a nuanced approach that requires careful consideration but can offer significant benefits when structured correctly.