Example 7

Determine a payment using a different interest frequency

This example demonstrates how to calculate a payment when interest is compounded at one frequency, separate from the payment schedule. This setup is common in consumer loans, like those with monthly repayments and quarterly interest compounding. Be mindful when performing these types of calculations that both the payment schedule and interest schedule should end on the same date to maintain consistency.

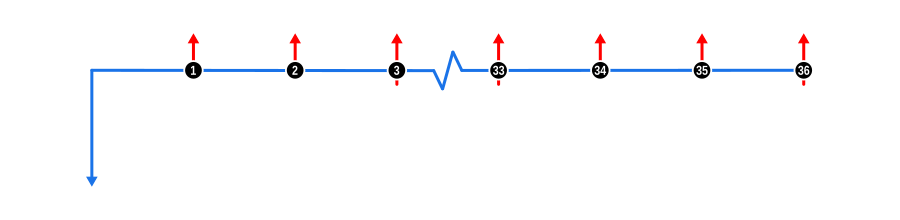

This example illustrates how to determine the payment value in a repayment schedule with a separate compounding frequency, in this case monthly repayments with quarterly interest. This example demonstrates the Interest Capitalisation Frequency feature of the calculator and is designed specifically for use by Finance Professionals, though it should be informative for all users. The diagram below visualises the cash flow dynamics:

Example Calculation Inputs

- Advance: This is shown by a blue downward arrow at the start of the timeline, indicating the value is known.

- Payments:

- The regular unknown payments are represented by red upward arrows.

- The quarterly interest capitalisation payments cannot be displayed as they have a zero value. However, there is one cash flow diagram notation used in this guide which has not been discussed yet, and that is the payment up arrows also extend for a short distance below the timeline. We use this to signify the payment includes capitalised interest. Note therefore in this example that the line only extends every third payment, when the repayment and interest schedules align.

Benefits and Implications

These types of repayment schedules are often found in consumer products offered by high street banks, with the following benefits and considerations:

Alignment with Accounting Practices:

- Simplified Accounting: By aligning interest compounding with accounting cycles (like quarterly reports), it can simplify the tracking and reporting of interest income for banks.

- Financial Reporting: Easier to match interest income with the periods in which it is earned, which is crucial for accurate financial statements.

Interest Rate Management:

- Rate Adjustment: Allows for more frequent adjustments in interest rates based on market conditions if compounded more often than payments are made, potentially benefiting lenders during rising rate environments.

Consumer Loan Products:

- Product Flexibility: Can be marketed as offering lower monthly payments while still providing the bank with higher effective interest rates due to compounding.

- Borrower Perception: Monthly payments might seem more manageable to borrowers, potentially increasing loan uptake despite higher effective interest.

Risk Management:

- Interest Capitalisation: Compounding interest increases the amount of interest capitalised, thus increasing the total amount owed more rapidly, which can act as a buffer for lenders against loan defaults.

- Prepayment Penalties: Structures like this can lead to higher penalties for early loan repayment, protecting lenders’ expected interest income.

Regulatory Compliance:

- Disclosure: This setup can affect how interest rates and total loan costs are disclosed to consumers, requiring clear communication to ensure compliance with financial regulations.

Liquidity Management:

- Cash Flow Alignment: Might help banks manage liquidity by having a predictable schedule of interest income that doesn’t necessarily align with the outgoings for payments.

Product Differentiation:

- Market Positioning: Can be used to differentiate loan products in a competitive market, offering unique repayment structures that cater to specific consumer segments.

Understanding these aspects can help finance professionals tailor loan products that not only meet consumer needs but also align with the strategic financial goals of lending institutions.