Example 6

Determine a payment with a balloon payment included

This example shows how to calculate a payment schedule that includes a significant final payment, known as a ‘balloon payment’. This amount might also be called a ‘future value’ or ‘guaranteed minimum future value’, depending on whether it’s for a loan or lease.

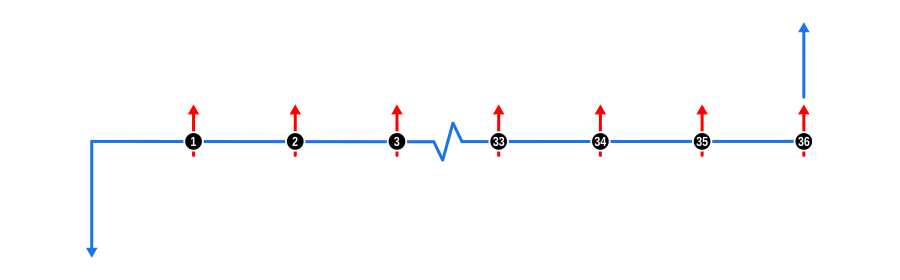

This example illustrates how to determine the payment value in a repayment schedule which incorporates a balloon or future value at the end of a repayment term. The diagram below visualises the cash flow dynamics:

Example Calculation Inputs

- Advance: This is shown by a blue downward arrow at the start of the timeline, indicating the value is known.

- Payments: Represented by red upward arrows, these are the regular unknown payments. Coinciding with the final payment is a larger blue up arrow representing the known balloon payment.

Benefits and Implications

Balloon payments are commonly utilised in various financial arrangements, particularly in:

Asset Financing:

- Vehicles and Equipment: Often used in car loans or equipment financing where the lender anticipates a significant residual value at the end of the term. This can be structured as an operating lease where the lender guarantees the value of the asset at lease end.

- Benefits for Borrowers: Allows for lower monthly payments, making high-cost purchases more manageable within cash flow constraints. It might also align with expectations of selling or refinancing the asset at the end of the term.

- Risks for Borrowers: Requires planning for a large lump sum payment or refinancing at the end, which could be challenging if financial conditions change.

Business Loans:

- Small Business: Balloon payments can be part of business loans where the business expects significant revenue or an event like selling the business at the end of the loan term.

- Strategic Financial Planning: Businesses might use balloon payments to match their cash flow cycles, expecting to pay off the loan with proceeds from future business success.

Lenders’ Perspective:

- Risk Management: By structuring a loan with a balloon payment, lenders can manage risk by ensuring a significant portion of the loan is repaid at the end, potentially secured by the asset’s residual value.

- Lease Rentals: In leases, balloon payments help in calculating rentals that account for the asset’s expected future value, providing a balance between regular payments and end-term value.

Investment and Savings:

- Structured Savings Plans: Certain savings or investment plans might use balloon payments to encourage long-term saving or investment, with the balloon representing a maturity or payout amount.

Market Conditions:

- Economic Cycles: In fluctuating markets, balloon structures can be adjusted to match economic forecasts, providing flexibility in repayment during uncertain times.

Understanding the dynamics of balloon payments is essential for both borrowers and lenders to manage cash flows, plan for future financial obligations, and structure agreements that align with anticipated asset values or business performance. This example provides a foundation for users to understand and navigate these financial structures effectively.