Example 5

Determine a payment in a 3+33 repayment profile

This example demonstrates how to calculate a payment schedule where the first three payments are due at the contract’s start, known as ‘in advance’. The remaining payments are then spread out. This structure is commonly utilised in small business loans, particularly for leasing arrangements.

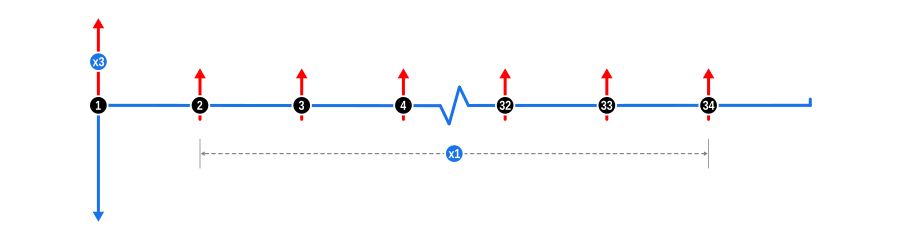

This example illustrates the use of ‘front loading’ a repayment profile on a proportional basis when solving for unknowns, and makes use of the Payment Weighting calculator feature. The 3+33 repayment structure is common in small business leasing arrangements, and variations on this exist, such as 3+35. This example is designed specifically for Finance Professionals, though it should be informative for all users. The diagram below visualises the cash flow dynamics:

Example Calculation Inputs

- Advance: This is shown by a blue downward arrow at the start of the timeline, indicating the value is known.

- Payments: Represented by red upward arrows, these are the regular payments. Notice though how the first payment in the series coincides with the Advance and is annotated with the x3 annotation. This is the weighted payment, followed by the remaining payments regularly spaced. The timeline continues for a further month after the final payment, suggesting the contract ends at the end of the final payment period. Note however the contract end date may vary between lenders and may also depend on the number of payments taken in advance.

Tip: It is permissible to assign whatever weighting ratio you need to the unknown values of two or more payment rows.

Benefits and Implications

The front loading of a repayment profile is typically used for these reasons:

- Risk Reduction: By securing multiple payments upfront, lenders reduce their risk exposure, especially in cases where there’s a higher likelihood of default early in the loan term.

- Cash Flow Management for Lenders: This structure provides immediate cash flow to the lender, which can be critical for managing liquidity, especially for smaller lending institutions or during economic downturns.

- Encouraging Loan Commitment: Front-loaded payments can incentivise borrowers to commit more seriously to the loan terms, knowing they’ve already made substantial payments at the outset.

- Adjusting for Seasonality: In industries with seasonal income, a 3+33 structure might align better with the financial cycle, allowing for lower payments during off-peak times while capitalising on peak cash flows initially.

- Tax Benefits: For the borrower, this structure might offer tax advantages if the payments are deductible, and making larger payments earlier in the fiscal year can maximise this benefit.

- Tailoring to Client Needs: Lenders can use this feature to customise loan terms to match the cash flow profile of different businesses, offering flexibility in how much is paid upfront versus over time.

- Pricing Strategy: The 3+33 profile might allow for different pricing strategies, where the interest rate or total cost of borrowing might be adjusted based on the reduced risk from front-loaded payments.

- Lease vs. Purchase Decisions: In leasing scenarios, this structure can make the lease more attractive by reducing the upfront cost while still providing the lender with security through immediate payments.

This example helps finance professionals understand how to leverage payment weighting to structure loans that balance risk, cash flow, and client satisfaction in various financial contexts.