Example 4

Determine a payment in an advance repayment profile

This example demonstrates how to calculate the value of a payment when it’s due at the beginning of each repayment period, known as ‘in advance’.

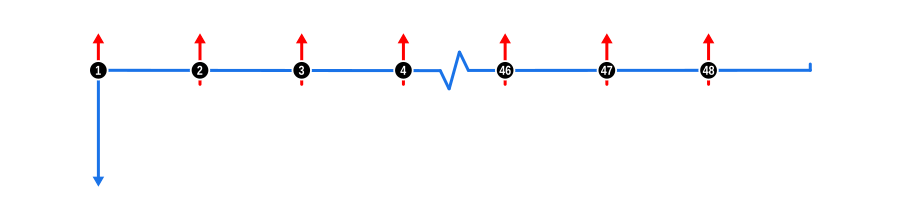

This example illustrates the use of one of two Modes, a core concept in financial calculations, when solving for unknowns. The ‘In advance’ payments are assigned a monthly frequency to show contrast with the previous example. The diagram below visualises the cash flow dynamics:

Example Calculation Inputs

- Advance: This is shown by a blue downward arrow at the start of the timeline, indicating the value is known.

- Payments: Represented by red upward arrows, these are the regular monthly payments. Notice how the first payment in the series occurs at the start of the first month coinciding with the Advance, and the remaining payments regularly thereafter.

Benefits and Implications

Understanding the implications of ‘In advance’ payment modes in financial calculations is crucial for these reasons:

- Payments ‘In advance’ reduce the overall interest repaid since capital reduction starts immediately (as opposed to ‘In arrears’ in Example 3).

- As a borrower or investor, recognising the mode helps in comparing financial products more accurately; for example, the effective interest rate can be lower with ‘in advance’ payments due to quicker principal reduction.

- Cash Flow Management: ‘In advance’ payments might require more initial cash on hand but can lead to lower total interest costs, beneficial for those with sufficient cash reserves.

- Savings on Interest: Over the life of the loan, ‘in advance’ can result in significant savings on interest, especially for long-term loans or high-interest scenarios.

- Budget Planning: This mode can affect monthly budgeting, as payments are due from the outset, which might be challenging for those with irregular income patterns.

- Negotiation: Understanding ‘in advance’ can give you an edge in loan term negotiations, possibly securing lower rates or better terms due to the lender’s reduced risk exposure.

- Loan Comparison: When comparing different loan offers, knowing if payments are ‘in advance’ or ‘in arrears’ can significantly alter the perceived cost of borrowing.

- Investment Products: For investments or annuities that pay ‘in advance’, the timing can affect the calculation of return rates, making it advantageous for investors looking for immediate income streams.

This example aids in understanding how payment timing affects financial outcomes, enabling better decision-making in personal or business finance scenarios.