Example 3

Determine a payment in an arrears repayment profile

This example demonstrates how to calculate the value of a payment when it’s due at the end of each repayment period, known as ‘in arrears’.

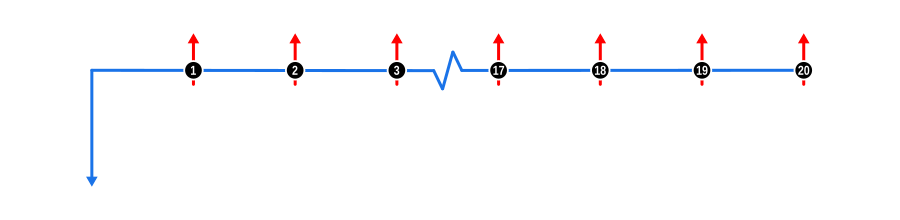

This example illustrates the use of one of two Modes, a core concept in financial calculations, when solving for unknowns. To mix things up, the ‘In arrear’ payments are assigned a quarterly frequency. The diagram below visualises the cash flow dynamics:

Example Calculation Inputs

- Advance: This is shown by a blue downward arrow at the start of the timeline, indicating the value is known.

- Payments: Represented by red upward arrows, these are the regular quarterly payments. Notice how the first payment in the series occurs at the end of the first quarter after the Advance, and the remaining payments regularly thereafter.

Benefits and Implications

Understanding the impact Modes can have in calculations is important for these reasons:

- Payments ‘In arrear’ increase the overall interest repaid as capital reduction is delayed (as opposed to ‘In Advance’ covered in example 4).

- As a borrower, knowing the mode used in finance quotes allows for accurate comparison; for instance, the implicit rate in a given repayment profile containing the same payment amount can vary significantly based on the repayment Mode, although the gap in the implicit rates tends to narrow as repayment terms lengthen.

- Cash Flow Management: ‘In arrear’ payments can align better with certain cash flow cycles, such as receiving income at the end of a period, which might be more suitable for managing personal or business finances.

- Impact on Total Interest: Understanding how ‘in arrears’ payments affect the total interest paid over the life of a loan can influence decisions on loan terms, especially for longer-term loans where the difference in interest can be substantial.

- Negotiation Power: Knowledge of payment modes can provide leverage when negotiating loan terms with lenders, potentially leading to better rates or terms if you can argue for a mode that suits your financial planning.

- Budgeting: For budgeting purposes, ‘in arrears’ payments allow for one more period of interest accumulation before the first payment, which might require adjustments in short-term financial planning.

- Loan Products: Some loan products, like certain mortgages or business loans, might only offer ‘in arrears’ payment structures, so understanding this mode is crucial for those considering these financial products.

This example helps you navigate these decisions by providing a clear financial picture based on different repayment structures and their implications on your financial health.