Example 1

Determine an advance amount

This example shows how to determine the maximum loan amount you can afford for personal or business needs. It calculates this based on your regular payment capacity and the lender’s interest rate.

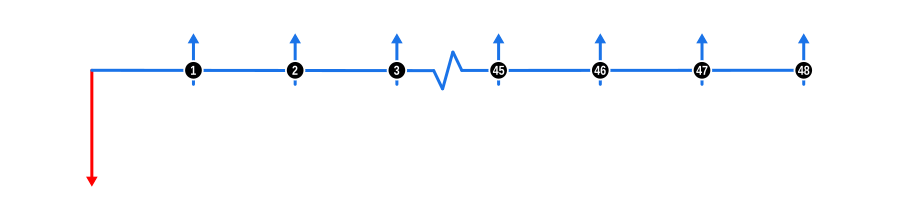

This example illustrates the concept of discounting future cash flows to determine their present value, which is crucial for assessing loan affordability. The diagram below visualises the cash flow dynamics:

Example Calculation Inputs

- Advance: This is shown by a red downward arrow at the start of the timeline, indicating the amount you’re solving for.

- Payments: Represented by blue upward arrows, these are the regular payments you can manage.

- Interest Rate: Although not shown in the diagram, this rate is used to discount the future payments to their present value. It can be based on a best guess or actual lender rate.

Benefits and Implications

Understanding how much you can borrow is vital for making informed financial decisions, especially when considering purchasing significant items. If the calculated loan amount falls short of what you need:

- You might need to contribute additional funds.

- Extend the loan term to lower monthly payments.

- Seek a lender with more favourable rates.

If the calculated amount exceeds your requirements:

- You could opt for lower monthly payments.

- Shorten the loan term to reduce overall interest paid.

This example helps you navigate these decisions by providing a clear financial picture based on your current capacity and market rates.