Multiple Interest Rate Calculations

As outlined in the introduction to this help guide, Curo Calculator does not support calculating unknown values in scenarios where interest rates change over time, like in fixed-to-variable rate mortgages, in a single step. However, you can perform these calculations by breaking them down into several steps. We’ll demonstrate this process using the default settings in Curo Calculator, concluding with how to calculate the Nominal Annual Rate (NAR) and Annual Percentage Rate (APR) implicit in the entire repayment schedule.

Fixed-to-variable rate lending is predominantly used within the mortgage industry. We’ll use a real-life example from an Irish mortgage lender to illustrate this concept. Typically, all necessary inputs are provided, but be ready to search for them if they aren’t. Here’s what you’ll need:

- Loan amount

- Fixed rate of interest

- Fixed repayment term

- Total repayment term

- Variable rate of interest

Fixed-to-Variable Interest Rate Mortgage Example

Fixed Rate Representative Example: €300,000 loan repayable over 30 years term, first five years fixed. Fixed rate of interest 4.50% per annum and 4.11% APRC*. 60 monthly repayments of €1,520.06 per month. On the expiry of a fixed rate period, your mortgage account will revert to a variable rate in accordance with the terms of your loan documentation for the remaining 300 months.

Variable Rate Representative Example: €300,000 loan repayable over 30 years. Rate of interest 3.85% per annum variable. 3.92% APRC*. 360 monthly repayments of €1,406.42 per month. Total amount payable is €505,718.08.

Source: https://capitalcu.ie/mortgages/

In the lender example above, the fixed repayment value of €1,520.06 per month is provided. This is not always the case, so we’ll start off showing how to calculate it.

Step 1: Determine/Confirm the fixed-rate repayment value

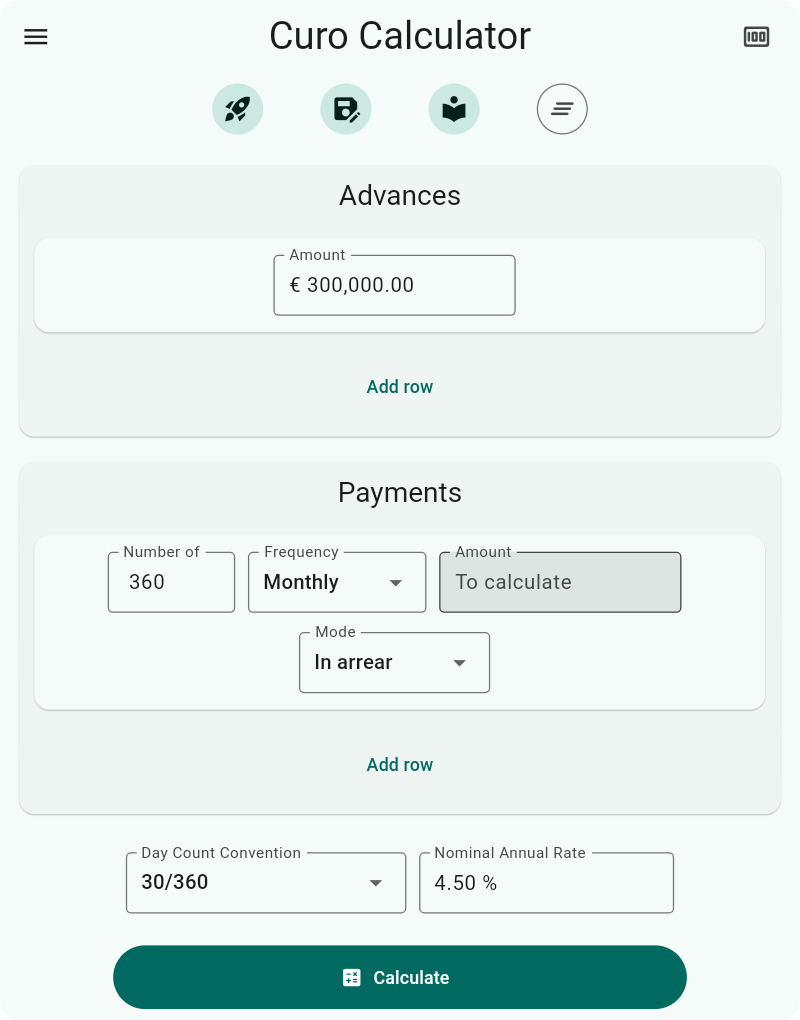

To calculate the unknown fixed repayment, we treat the entire 30-year term as the fixed repayment period and use the fixed rate of interest in the calculation. The required inputs are as follows:

- Advances Amount: Enter the loan of €300,000.00

- Payments: Ensure the payment row has the following inputs/selections:

- Number of: 360

- Frequency: Monthly

- Amount: Leave blank as we are calculating this

- Mode: In Arrear

- Day Count Convention: Select the 30/360 (this convention assumes each month has 30 days and each year has 360 days for calculation purposes)

- Nominal Annual Rate: Enter the fixed rate of 4.50%

Once done, the inputs should match the image below.

After pressing the Calculate button, make a note of the payment result as we use this as input in Step 2.

Step 2: Determine the fixed-rate period end balance

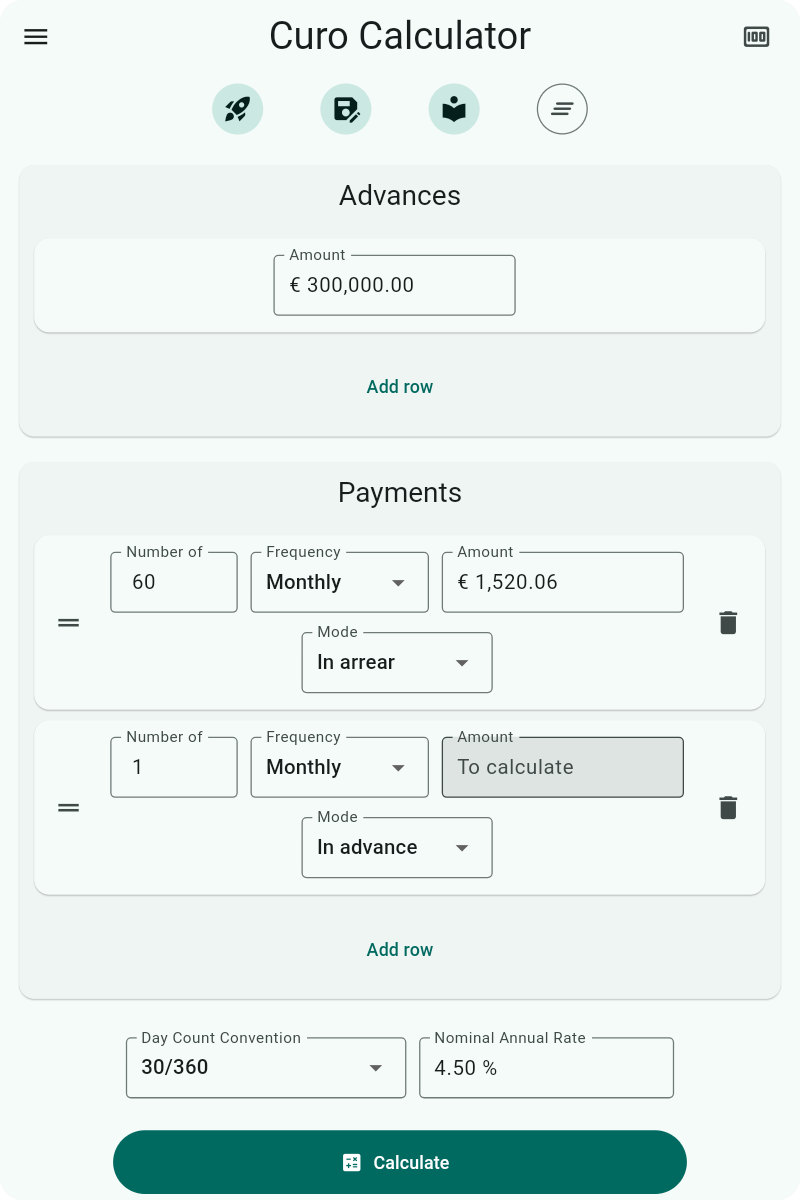

To calculate the value of the variable rate repayments, we first need to determine the capital balance outstanding at the end of the five-year fixed term. To do so, amend the calculator input as follows:

- Payments: In the payment row from Step 1, leave everything as is except for:

- Number of: Change from 360 to 60

- Amount: Enter the payment value result (€1,520.06) from Step 1

- Now select the ‘Add row’ link below the previous row, which we’ll use to calculate the balance after 5 years:

- Number of: Enter 1

- Frequency: leave as ‘Monthly’

- Amount: leave blank as this is what we are calculating

- Mode: Here, we use ‘In Advance’ because we’re calculating the balance after the last fixed payment has been made

When you are done, your calculator input will be the same as shown below.

After pressing the Calculate button, make a note of the result as we use this as input in Step 3.

Step 3: Determine the variable-rate repayment value

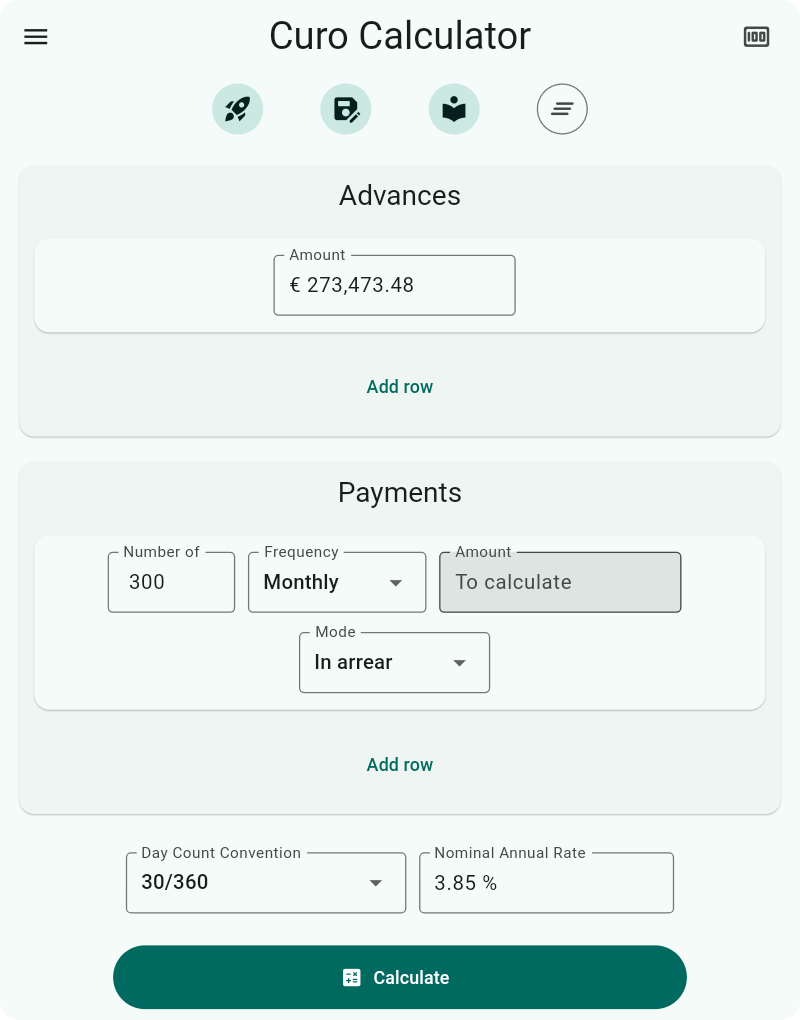

Now that we know the balance at the end of the fixed term, we can calculate the variable-rate repayments for the remaining 25 years. First, remove the second payment series row we added in Step 2, as it was only needed for calculating the balance after the fixed term. Then, use the following inputs:

- Advances Amount: Enter the balance from Step 2 as the new loan amount (€273,473.48).

- Payments: With the second row removed, amend the remaining payment row as follows:

- Number of: 300 (since 360 total months minus 60 fixed months)

- Frequency: Monthly

- Amount: Leave blank to calculate

- Mode: In Arrear

- Day Count Convention: Select 30/360

- Nominal Annual Rate: Enter the variable rate of 3.85%

After calculating, make a note of this new repayment amount for the last step.

Step 4: Determine the NAR and APR implicit in the schedule

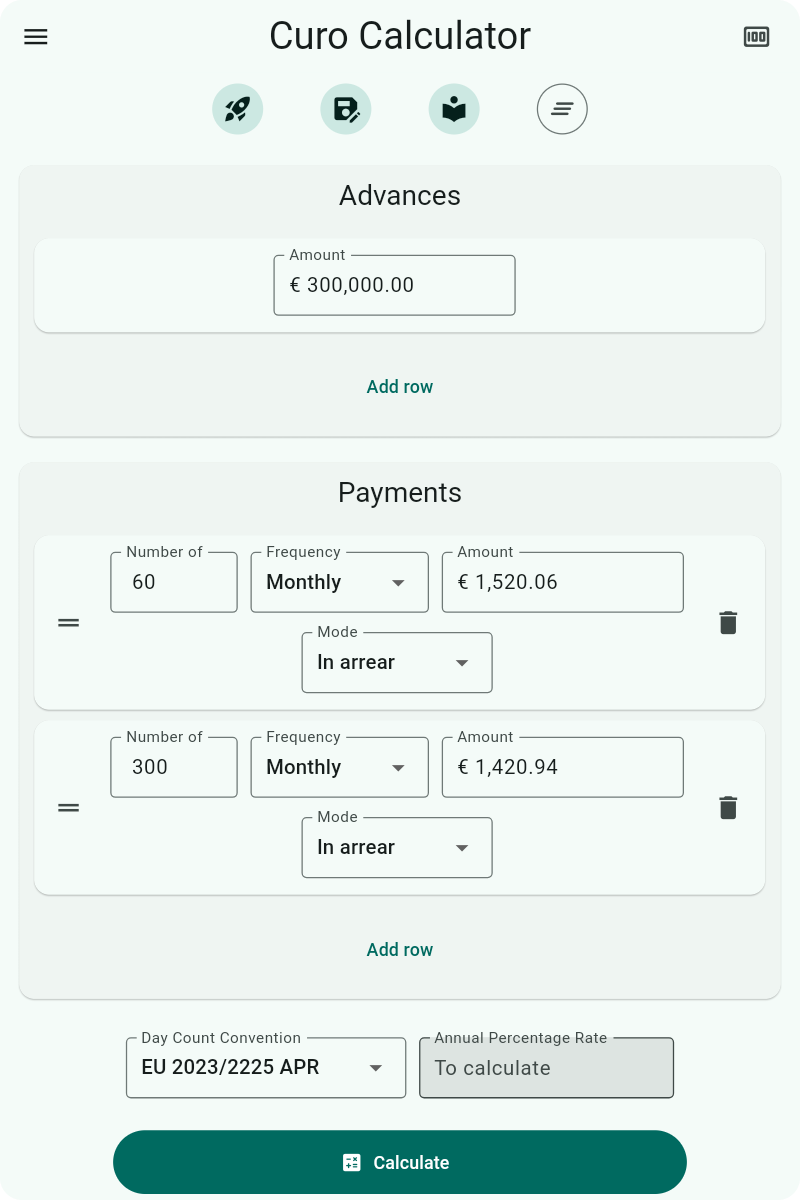

To calculate the NAR and APR it’s probably wise to clear all calculation inputs and start with a clean slate. Whatever route you take the required inputs are as follows:

- Advances Amount: Enter the loan of €300,000.00

- Payments:

- Row 1: Ensure the payment row has the following inputs/selections:

- Number of: 60

- Frequency: Monthly

- Amount: €1,520.06

- Mode: In Arrear

- Row 2: Add another row and ensure it has the following inputs/selections:

- Number of: 300

- Frequency: Monthly

- Amount: €1,420.94

- Mode: In Arrear

- Row 1: Ensure the payment row has the following inputs/selections:

When you are done, your calculator input will be the same as shown below.

To calculate the NAR:

- Day Count Convention: Select the 30/360

- Nominal Annual Rate: Leave blank as this is what we are to calculate

To calculate the APR:

- Day Count Convention:

- Select EU 2023/2225 APR for European Union mortgages

- Select UK Mortgage APR for United Kingdom mortgages

- Select 30/360 EAR as a proxy in other parts of the world

- Annual Percentage Rate: Leave blank as this is what we are to calculate

By following these steps, you can now use Curo Calculator to effectively manage and analyse fixed-to-variable rate mortgage scenarios. Understanding how to break down these calculations into manageable steps not only aids in financial planning but also gives you a clearer picture of the long-term implications of varying interest rates on your repayments. Remember, while Curo Calculator simplifies these processes, real-world applications might require additional considerations like fees, insurance, or changes in policy that could affect your mortgage. Keep this guide handy as a reference, and always consult with a financial advisor for personalised advice tailored to your specific circumstances.